- Passionate Income

- Posts

- Big Bitcoin Moves by October?

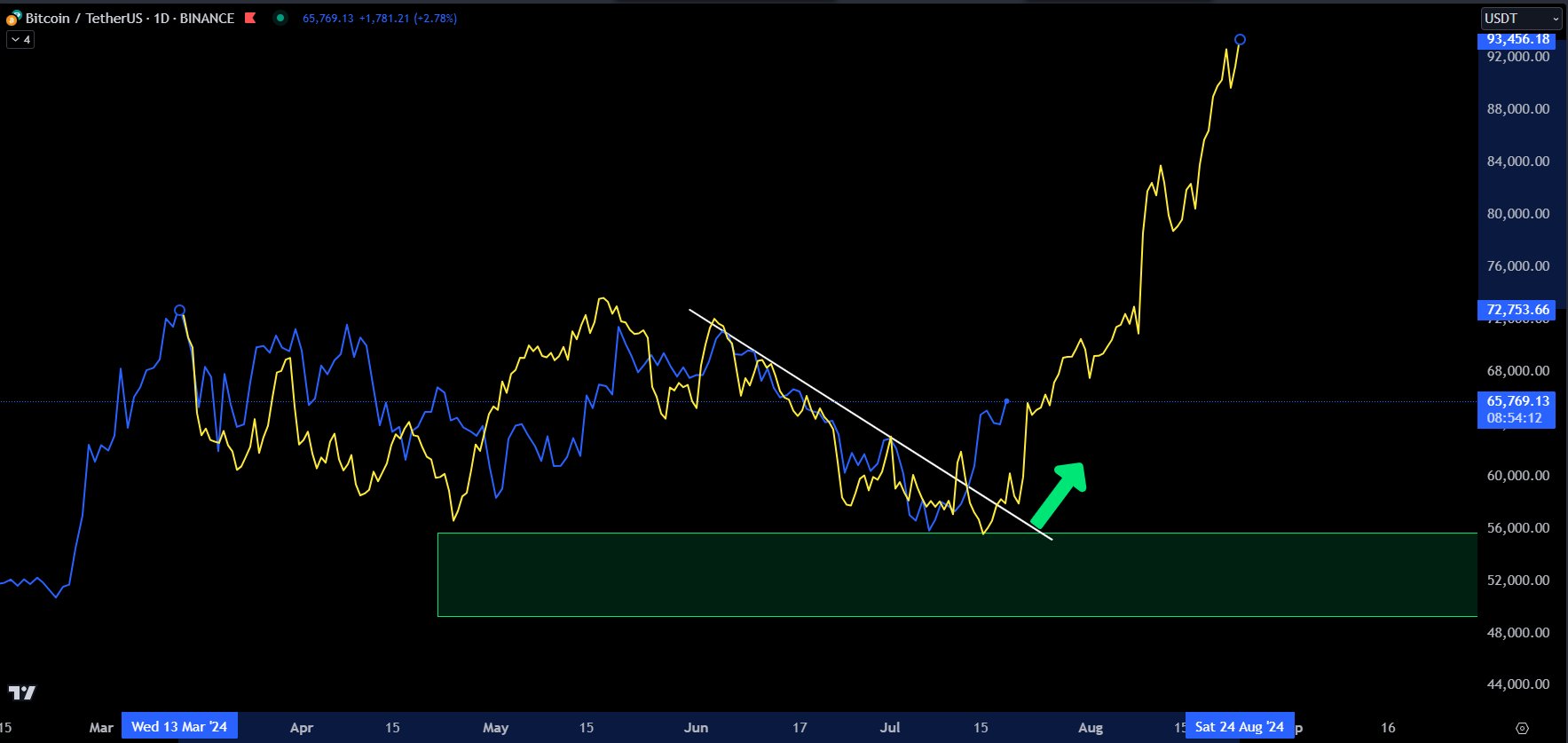

Big Bitcoin Moves by October?

We should get clarity (soonish)....

1,175 Words | 4 Min 54 Sec Read

Today we’ll be discussing why crypto is at a critical pivot point, with upcoming moves likely determining the direction of the market for the next 3-6 months.

Let’s dive in.

Breakthrough: 21-year-old entrepreneur goes viral after people found out about his amazing “secret” $3,000/day Instagram loophole.

The same method 100+ of his clients used to go from 0 to $3k online in 90 days

“Listen, I’ve built these secret tactics from ground zero over the last 2 years.

I’ve never seen anybody else replicate what I do and not make at least +$3,000 each month.

The truth is:

These tactics are extremely easy to use, and even my grandmother could hit $3,000 in the next 90 days.”

That’s what this 21-year-old said.

If you want to know how he’s doing it and how he’s helping over 100 other everyday people just like you. Click on this to find out more.

Disclaimer: We are not financial advisors and we are definitely not your financial advisor. Crypto investing is high risk and can result in you losing 100% of your capital. The information contained in today's issue exists for entertainment purposes only, and shall in no way be considered financial advice.

It's been about two months since our last check-in, so I thought today would a be a good time for another market update.

First things first, memes are dead or on life support.

As we discussed in our Meme Coin Investing 101 issue from June, memes went on a tear from November through March.

Sadly, they've struggled ever since then.

Especially as it relates to their performance relative to Bitcoin. See, in crypto, you always have to ask yourself:

"Is investing into this asset likely to provide me a higher return than just investing into Bitcoin itself?"

The reason this question is so important is because Bitcoin is the gold standard in crypto. There are multiple reasons for this.

First, it's the largest cryptocurrency by far (measured in terms of Market Cap).

Second, it's the oldest (given it was the first) and most trusted.

Third, while Bitcoin doesn't go up as much as other riskier coins, it also doesn't go down as much. Meaning, relative to other cryptocurrencies, $BTC is in most cases the safest (because it provides the least downside risk).

Add these three factors together and it doesn't make sense to expose yourself to higher levels of risk (trading / investing into Alt Coins or Meme Coins) if investing in the safer option (Bitcoin) is likely to bring you higher returns.

Of course, no one can predict the market.

And when things are flying, alt / meme coins will almost always go up more than BTC.

Sadly, Q2 and Q3 brought us more of a crash than it did any kind of soaring.

In fact, Bitcoin topped out at ~$71,300 during the last week of Q1 and has been slowly but steadily dropping since then (to its current price of approximately $57,000).

Which makes for a near 20% drop.

Meme coins, however, have dropped much more.

As an example, 2023 Q4 darling $WIF is down a stunning 68.3% from it's March 31st high.

Same for $BONK, which peaked in March - then again in May - before crashing 55%.

And those are the big mega-cap memes.

Get into the sub $50M market cap tokens and we're seeing drawdowns of anywhere from 50-90%.

As an example, $KEYCAT - which rose as high as a $120M market cap - is down 19% today alone and 93% from its previous All Time High.

With that said, there's more to crypto than just memes.

Because as of today, the real question is what Bitcoin is going to do.

As we've discussed in previous check-ins, Bitcoin leads the market. When it goes up, most everything else goes up.

And when it falls, most everything else falls harder.

Meaning, if we don't get a rally in Bitcoin, crypto as a whole will continue to fall.

So what triggers are on the horizon?

While things looks ugly in the short-term, there are multiple bright spots as we look to Q4.

First and arguably most important, the Fed (United States Federal Reserve) is expected to cut interest rates in September (with experts from the CME Group / Fed Watch predicting a 100% chance of cutes).

This would provide much needed relief to both corporate America and American consumers, affecting everything from mortgages to corporate debt restructuring rates.

Second, after years of taking money out of the system to tame inflation (known as quantitative tightening / QT), the Fed is likely to shift from a tightening stance to a more neutral stance (defined as Quantitative Neutral).

Think of it like a teacher who can both hand out candy to his/her students, or take that candy away.

Since 2022, the Fed has been taking candy away from its students (draining liquidity out of capital markets to slow economic growth).

And while it can't turn the spigot back on quite yet (given that could spark a second wave of inflation), shifting from taking candy away - to not doing anything with the candy - is a great move in the right direction.

Third, a variety of fractals and historical patterns show the downturn we're experiencing right now is a normal and much needed part of the cycle (despite how uncomfortable it may be).

From fractals to historical patterns, a variety of data points show there are better days ahead.

BTC/AAPL Fractal

And it's not just patterns and charts.

On a fundamental level, Bitcoin is being adopted by institutions on an increasingly rapid basis.

From banking giants like Morgan Stanley and Goldman Sachs confessing they hold 9-figures in Bitcoin ETF holdings, to Ripple winning it's multi-year lawsuit against the SEC, there are very few signs indicating crypto is "over."

With that said, Bitcoin prices tend to follow the stock market.

And right now, professional investors have conflicting opinions regarding which direction stocks are headed for Q3 and Q4.

If we're lucky, both stock and crypto will break their previous all-time highs, sending us into a raging bull market that will likely come to an end during Q1 of 2025.

If not, it's likely things break down from here and do not recover until some time next year.

Fortunately, it's likely a direction will be decided sooner rather than later. Most likely before the end of September.

So be careful and protect your capital until it's clear which direction we're headed.

💡 Takeaway: Bitcoin has been in a sideways range for almost six months now, with most smaller cap alt coins / meme coins bleeding out since March. Fortunately, both historical patterns and a variety of timing cycles show we are likely to get a decisive move by October at the latest.

🎁 Resources:

FREE COURSE: Build a Faceless IG Page (from a guy with 10M+ followers)